tax benefit rules for trusts

All of the tax rules for hiring employees apply to resident managers but there are a couple of special rules you need to know about. Many estate plans that utilize Jointy Revocable Trusts povide for separate marital trust to be created upon the death of the first spouse for benefit of the surviving spouse and direct that all the income be distributed ot the surving spoues along with discretionary principal distributions to the surviving spouse out of the deceased spouses share of the estate.

Canada S New Income Splitting Tax Rules And Family Trusts Insights Dla Piper Global Law Firm

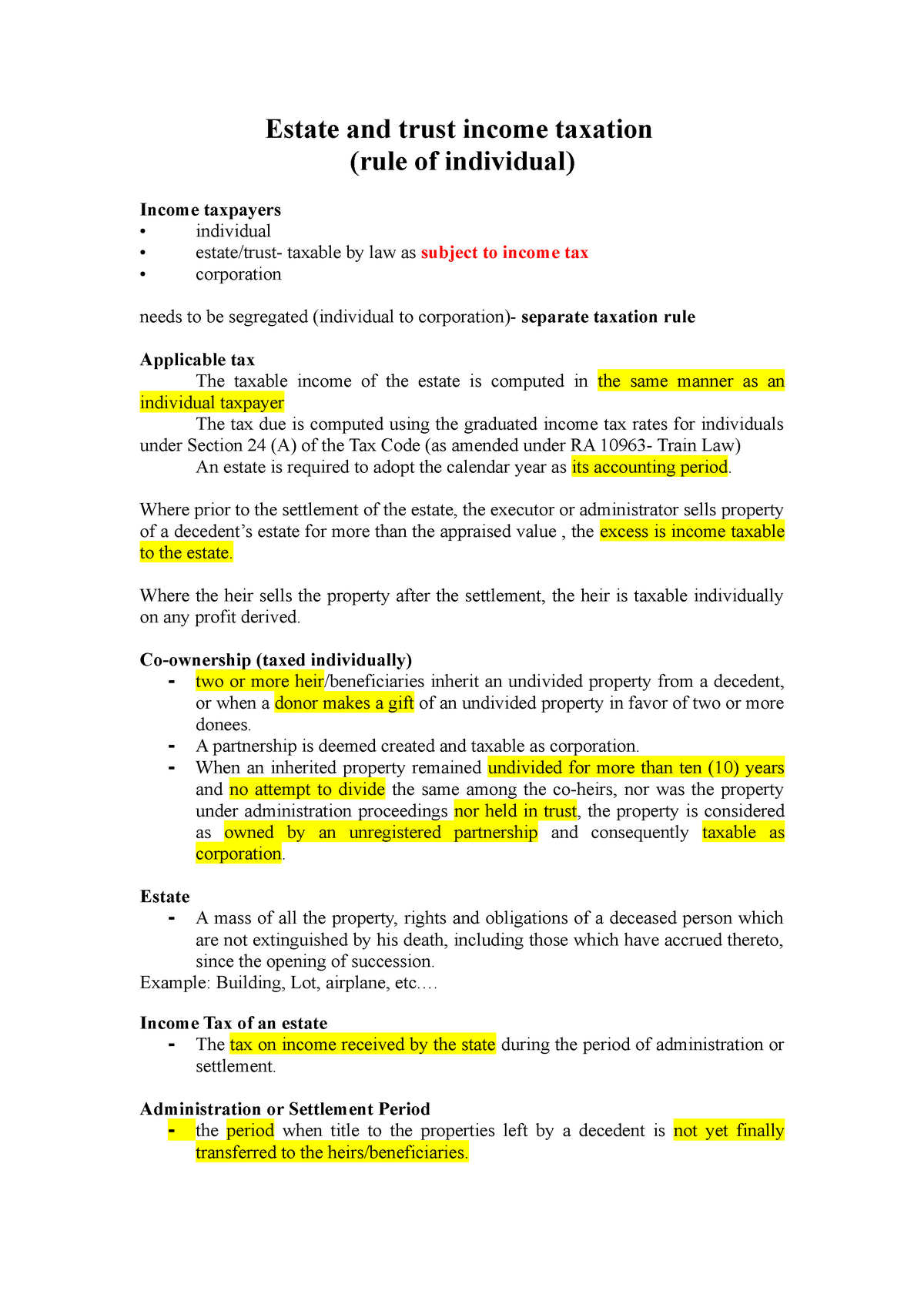

Taxation of Estates.

. The owner of an annuity may be a natural or non-natural person. In light of the new rules enacted by the law known as the Tax Cuts and Jobs Act PL. There are specific rules for some types of trusts including unit trusts managed investment trusts family estates deceased estates super funds charitable trusts and special disability trusts.

Natural Owner of an Annuity. 115-97 and recent final. Some trusts do not have to send in an IHT100 form as long as they meet the rules for excepted transfers and settlements - usually trusts with a low value.

The beneficiary receives the death benefit or any remaining annuity payments upon the death of the owner. Some examples of non-natural persons are corporations partnerships and trusts. No Payroll Taxes for a Resident Managers Free Lodging If you pay a resident manager a regular salary you must pay and withhold federal payroll taxes which consist of Social Security and Medicare taxes unemployment taxes and federal income.

Charitable deduction rules for trusts estates and lifetime transfers By Marcy Lantz CPA and Joylyn Ankeney CPA Aldrich CPAs Advisors LLP Lake Oswego Ore. Doing the exit charge calculation yourself. 12 May 2016 QC 23083.

A natural person is a human being for example.

Why Everyone Needs An Estate Strategy William H Bryan Retirement Advice Investment Advice Strategies

Pin By Debbie Wolfe On Trusts Estate Tax Tax Return

How To Find The Best State To Place Your Trusts Retirement Watch Retirement Lifetime Income Investment Advice

The Use Of Family Trusts By Business Owners

Some Trust Distributions Are Subject To Tax Distributions Can Be Structured In Different Ways Revocable Living Trust Estate Planning Attorney Estate Planning

Distributable Net Income Tax Rules For Bypass Trusts Tax Rules Net Income Income Tax

Trust Registration Service 2020 Trust Tax Rules Online Trust

Jk Lasser S New Rules For Estate Retirement And Tax Planning Ebook By Stewart H Welch Iii Rakuten Kobo Free Books Online Books To Read How To Plan

The Use Of Family Trusts By Business Owners

How The 7 Year Inheritance Tax Rule Works Inheritance Tax Tax Rules Inheritance

Portfolio Of The Week Ciaran Hughes Visualoop Infographic Creative Infographic Portfolio

The Use Of Family Trusts By Business Owners

Canada S New Income Splitting Tax Rules And Family Trusts Insights Dla Piper Global Law Firm

The Benefits Of Family Trusts Advisor S Edge

All About Institutional Donors Proposalforngos Fundraising Strategies Grant Writing Proposal Writing